Resending Tax Receipts to Your Donors

Although CanadaHelps issues tax receipts on your behalf, if you receive requests from donors asking if you can resend their tax receipt, here is how to do so:

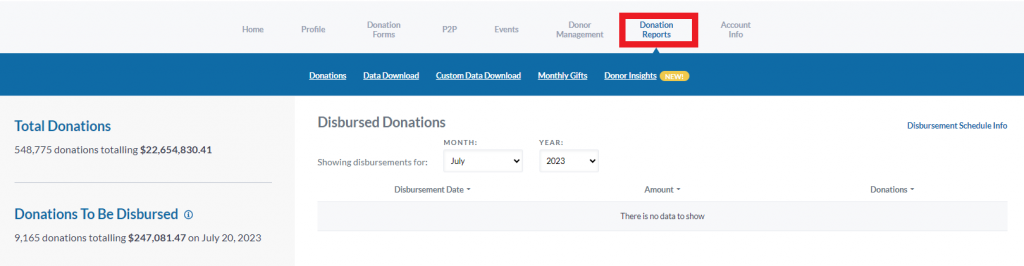

1. Login to your CanadaHelps charity account and click on the Donation Reports tab.

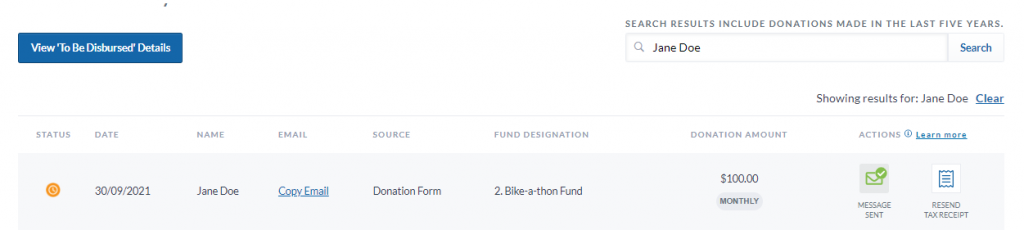

2. Scroll down to the Donation Summary section and find the donor in the list. Or, use the search bar to look for the donor.

3. Under the Actions column next to the donor’s details, click Resend Tax Receipt.

4. A pop-up prompt will ask you to verify the donor’s email address. If correct, click Send Receipt.

TIP: If the donor’s email address is incorrect, please advise the donor to contact our support team and we’ll take care of the rest.

The Resend Tax Receipt button is available for one-time and monthly donations made on:

- your Profile page

- any of your Customizable Donation Forms

- any of your Peer-to-Peer fundraising campaigns

- any donations of securities made to your organization.

NOTE: If a donor has selected the option to receive an aggregate receipt, their receipt will only be available for resending by February of the following calendar year.

The Resend Tax Receipt button won’t appear for donations that:

- have been refunded

- were made through a Customized Donation Forms that has tax receipting disabled

- were made by Anonymous donors

- were made through an Event page

NOTE: you can resend event ticket/event donation tax receipts through the Ticketed Events tool.