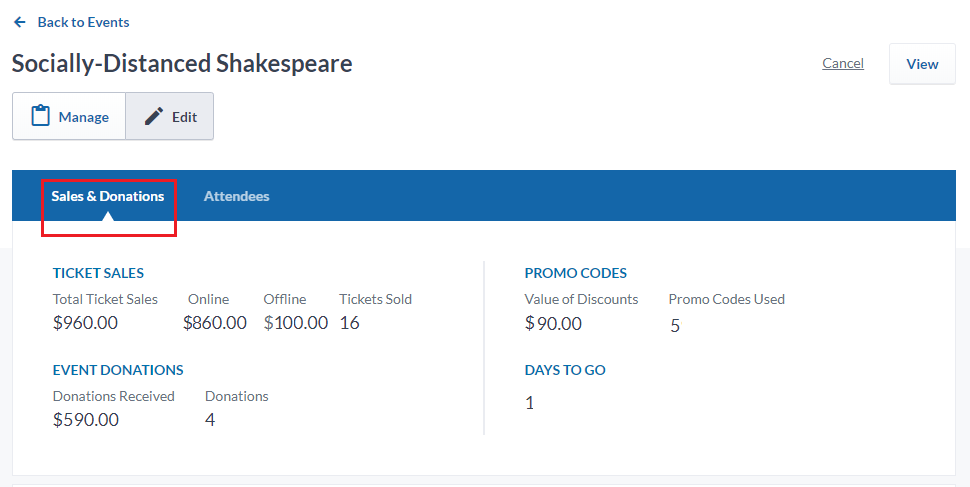

Sales and Donations Tab

The ‘Sales and Donations’ tab allows you to see real-time progress of your ticketed event.

Across the top, use a dashboard will display real-time sales information.

Below, the ‘Sales’ section will show you a real-time list of purchasers/event donors.

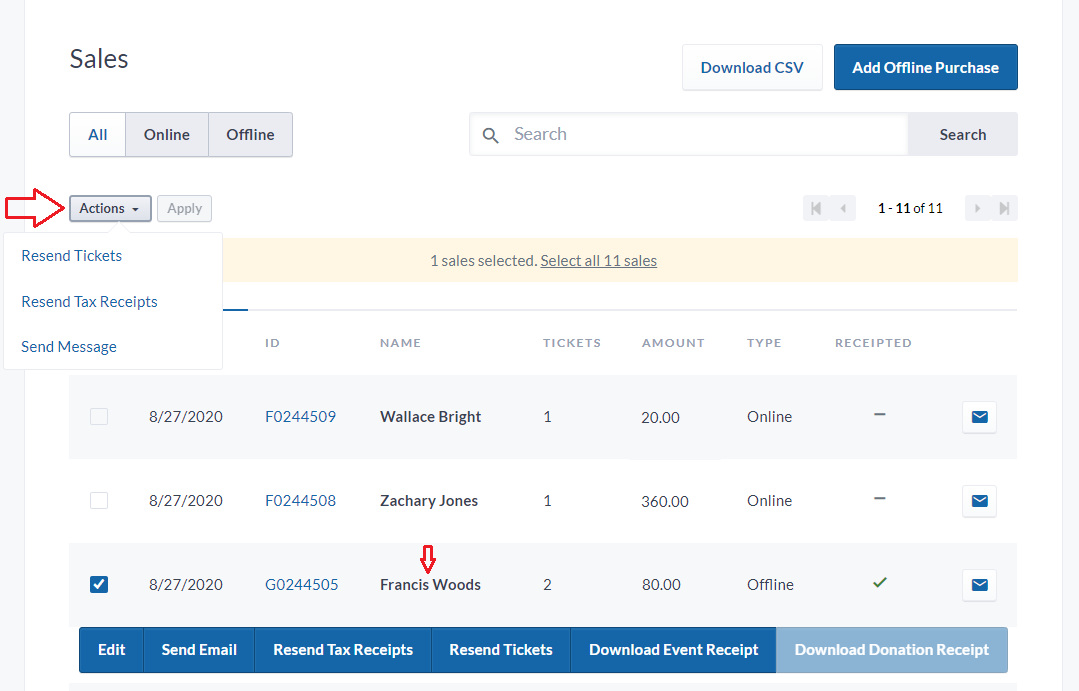

1. Click on the ‘Actions’ button (or click on a purchaser name) to resend a purchaser their tickets or tax receipts, or to send individual/mass emails to purchasers.

NOTE: If you’ve selected “No Tax Receipt” or “Post-Event Tax-Receipting” for your event, any tax receipt-related actions will be inactive.

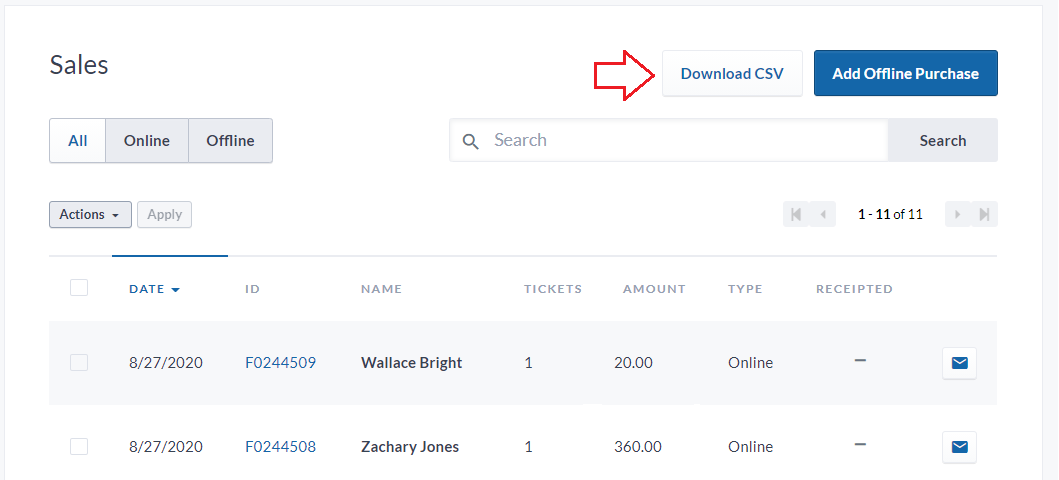

2. You can also download a .CSV report containing all relevant information about ticket purchasers/donors.

TIP: This report will contain the answers to any questions you’ve asked your purchasers upon payment.

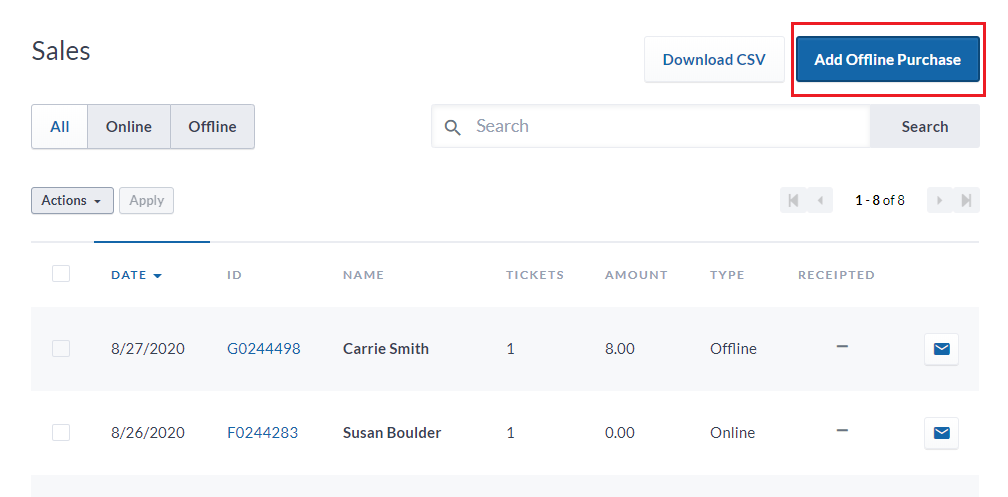

Adding Offline Purchases

3. Adding Offline Purchases helps keep the totals raised for the ticketed event as accurate as possible, especially if you are allowing individuals to purchase tickets by cash, cheque, etransfer, etc.

NOTE: As with online ticket purchases and donations through your ticketed event, your charity is the legal issuing party for any/all tax receipts (i.e., the tax receipts will bear your uploaded signature and logo).

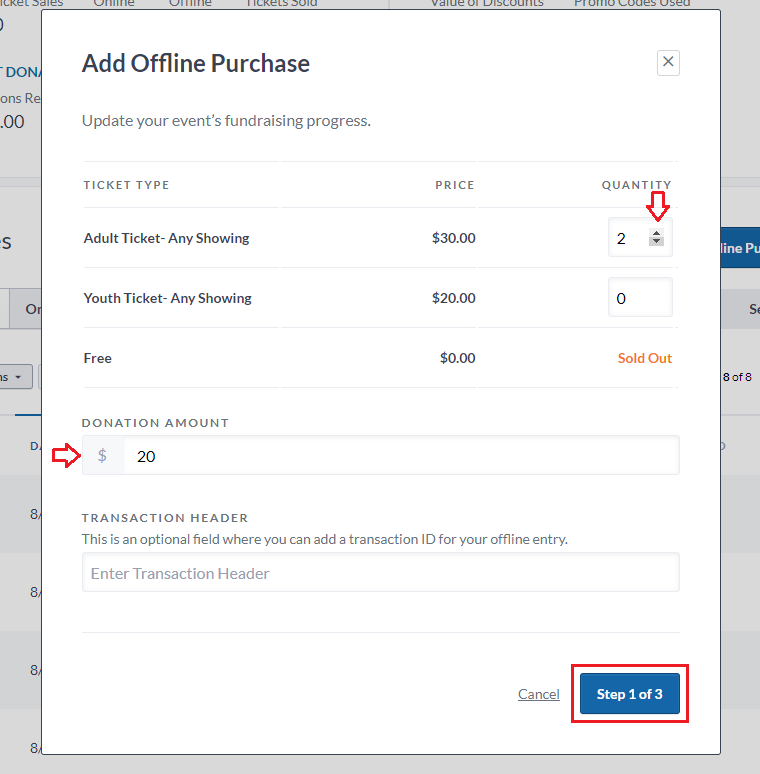

a) On the ‘Sales and Donations’ tab, click on the ‘Add Offline Purchase’ button.

b) Select the type of ticket that you want to record, and if applicable, the donation amount.

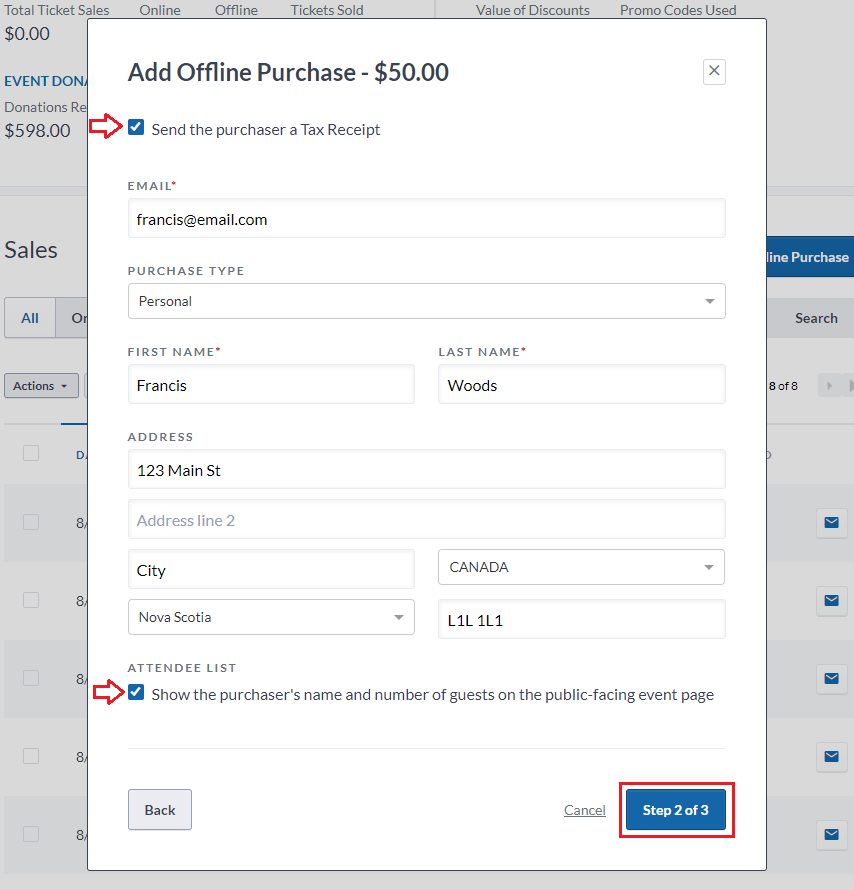

c) Fill out the Purchaser’s details and check off if you’d like to send the Purchaser a tax receipt, as well as show their name in the (public-facing) List of Attendees.

d) Check off if you’d like to send the Purchaser their Event Ticket(s), and if you’d like to add Attendee information (i.e., if you need to ask attendees a question to facilitate check-in).

e) If you are collecting Attendee information, you can also check-off to send an attendee/s their ticket/s and reminder emails.

f) Fill out the Attendee details and click ‘Add Purchase’ when done.