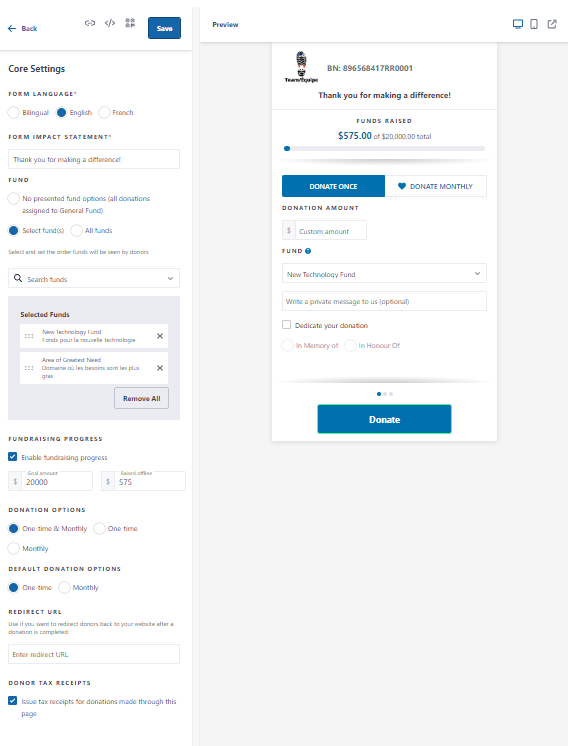

Form Set up – Core Settings

Here is where you will determine the most critical settings for your customized donation form.

Funds

In this section, you can choose to have all donations directed to your Charity’s “General Fund“, in which there would be no drop-down menu for donors to choose from. Or, you can choose a selected list of fund designations to be available on your customized donation form, in which donors would choose their fund through the use of a drop-down menu. Lastly, you can choose to display all funds available on your customized donation form, in which donors would choose their fund through the use of a drop-down menu.

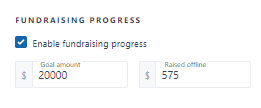

Progress Bar

Encourage giving by adding a Fundraising Progress bar that tracks donations made through your donation form.

TIP: Keep the total amount raised as accurate as possible by periodically adding any offline donations you’ve received in the “Raised offline” field. CanadaHelps does not issue tax receipts for any amounts added in the Offline Amounts field.

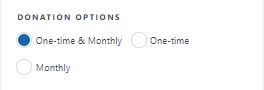

Donation Options

Set your donation form to collect only One-Time donations, only Monthly donations, or both.

NOTE: Donors will always see a small hyperlink allowing them to make the other type of donation.

Example:

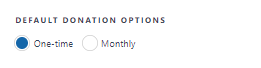

Default Donation Options

Stimulate either one-time donations or monthly donations by setting a “default” donation option on your customized donation form. The donor will still be able to choose the other donation option.

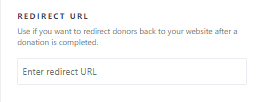

Redirect URL

Choose which webpage your donor will be redirected to once they complete their donation.

NOTE: The donation confirmation screen will count down from 10 and redirect donors to the URL inserted here.

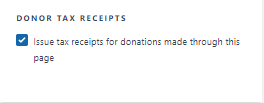

Donor Tax Receipts

This is probably the most critical setting for your customized donation form. By default, tax receipts are enable however this setting can always be disabled by unchecking the box pictured below.

Important: If donations are facilitated through a customized donation form while this setting is disabled, at no point will a tax receipt be issued for this donation.

Up Next: Donor Options