Tax Receipting

CanadaHelps automatically issues electronic tax receipts for all donations made through our platform, including donations made through:

- Your charity profile page or profile campaign on CanadaHelps.org

- Customizable Donation Forms

- Peer-to-peer (P2P) campaigns

- Securities donations (charity profile page or Securities Donation Form)

- Cryptocurrency donations

- Unite for Change Cause Fund

—-> Learn how to resend a donor their tax receipt for any donations made through CanadaHelps or direct the donor to our receipt download tool for copies of their tax receipts for any tax year!

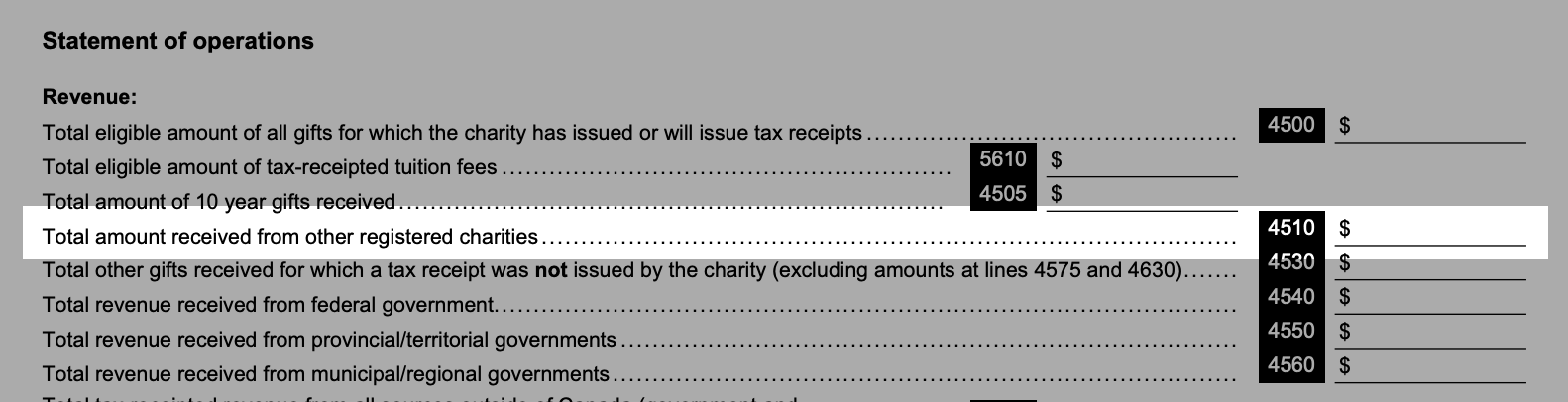

Filing with the CRA

Considerations

Ticketed Events:

Only in the case of ticketed events, your charity is required to upload your logo and authorizing signature- making your organization the legal issuer of tax receipts for any ticket purchases and donations received through that event.

So, if you decide to issue tax receipts for your ticketed event, you must report any ticket sales or event donations in your T3010 as donations for which you have issued a tax receipt. Learn more.